California Assembly Republican Caucus

Wildfire Resources

USFS Region 5 Wildfire Crisis

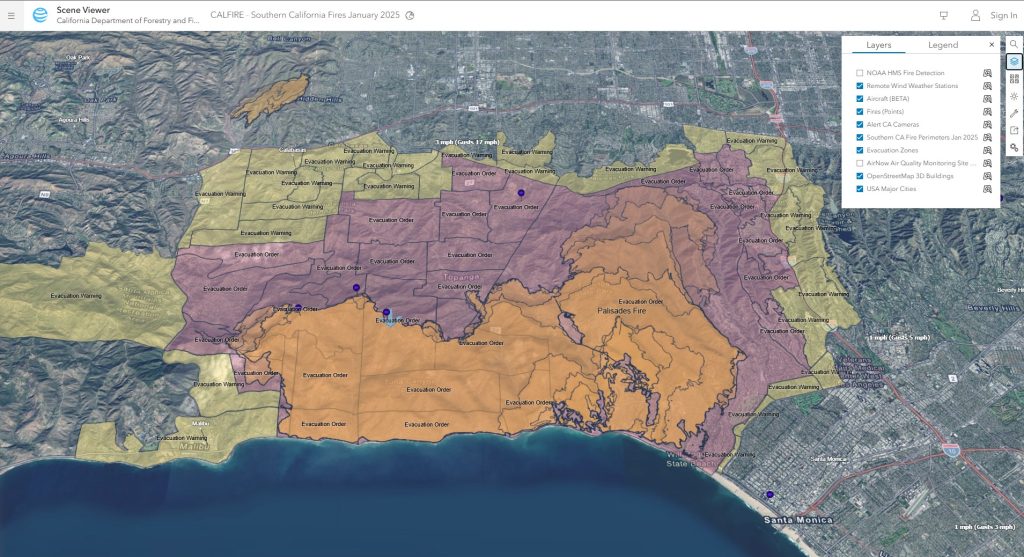

CalFire Interactive Maps

CalFire Resource Page

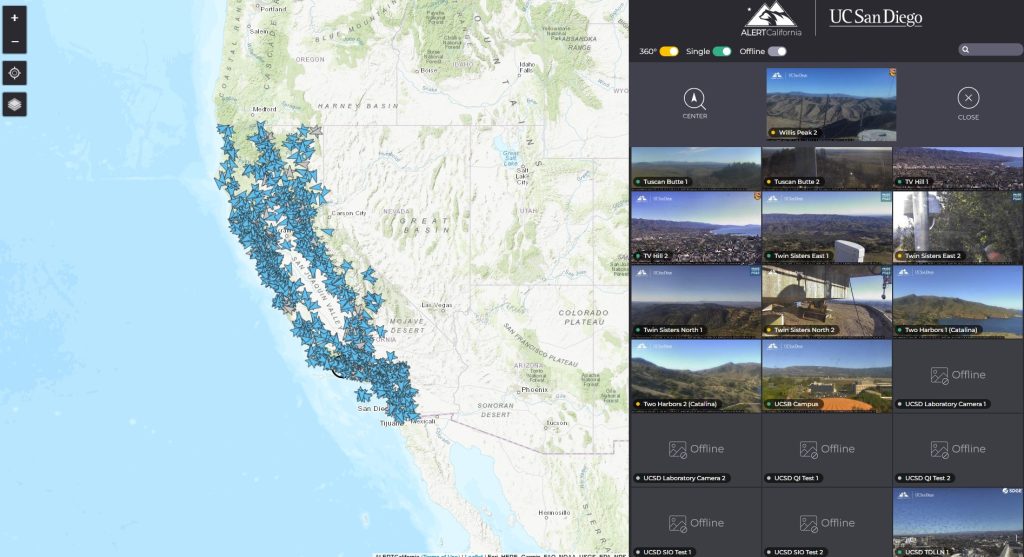

Alert Wildfire Interactive Cameras

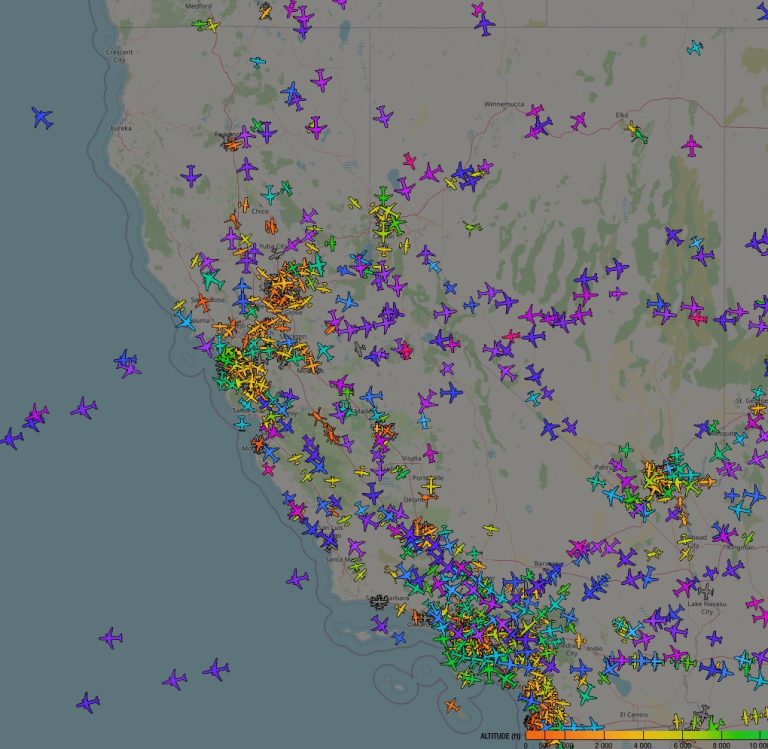

ADSB Flight Tracking

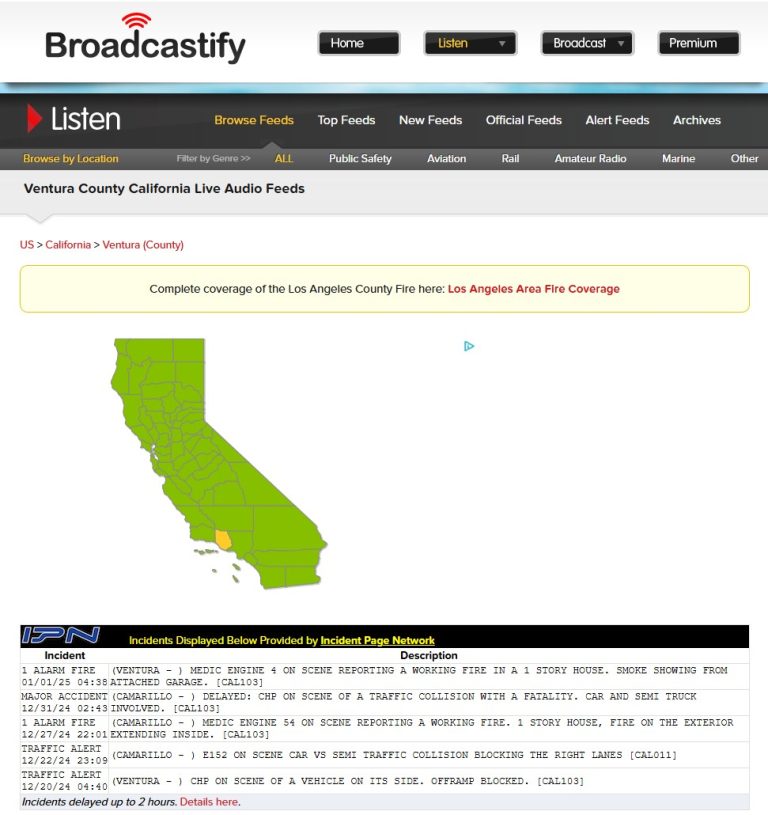

Listen to Broadcastify

National Interagency Coordination Center - Incident Management Situation Report (IMSR)

Resources for Rebuilding

1. Ensure Your Safety

– Prioritize the safety of yourself and your family.

– Follow evacuation orders and wait until it is safe to return to your property.

2. Document the Damage

– Take photos and videos of the damage if it’s safe to do so. Document the loss thoroughly.

– Create a list of damaged or lost items, including their approximate value.

3. Contact Your Insurance Company

– Notify your homeowner’s insurance company immediately.

– Request a copy of your policy if you don’t have it.

– Start the claims process by providing your policy number and the details of the loss.

– Ask about additional living expenses (ALE) coverage for temporary housing and related costs.

4. File an Insurance Claim

– Provide your insurance adjuster with all necessary documentation, including:

– Photographs/videos of the damage.

– Inventory of lost or damaged belongings.

– Receipts or proof of purchase for major items (if available).

– Maintain a log of all interactions with your insurance company, including dates and times.

5. Explore State and Federal Assistance

– Contact the **California Office of Emergency Services (Cal OES)** or FEMA to see if you’re eligible for disaster assistance.

– Register with FEMA at (https://www.disasterassistance.gov) or call 1-800-621-FEMA.

– Apply for a Small Business Administration (SBA) disaster loan if needed for rebuilding.

6. Secure Temporary Housing

– Use ALE from your insurance policy to cover temporary housing costs, meals, and transportation.

– Check with local relief organizations, such as the Red Cross, for assistance.

7. Prevent Further Damage

– If possible, take steps to mitigate further damage (e.g., boarding up windows or tarping roofs).

– Keep receipts for any expenses related to securing your property.

8. Obtain Building Permits

– Contact your local government to understand rebuilding requirements and zoning codes.

– Obtain necessary permits before starting construction.

9. Work with Contractors

– Choose a licensed, insured, and experienced contractor.

– Request written estimates and review contracts carefully.

– Avoid paying large upfront deposits.

10. Monitor the Rebuilding Process

– Work closely with contractors and inspectors to ensure quality and compliance.

– Maintain regular communication with your insurance adjuster.

11. Seek Legal or Professional Advice

– Consult a public adjuster or attorney if disputes arise with your insurance company.

– Consider hiring a financial advisor to help manage rebuilding costs.

12. Stay Informed

– Follow updates on fire recovery efforts from local authorities and community organizations.

– Stay organized with all documents and receipts in case of future audits or additional claims.

Prop 13

Under California’s Proposition 13, the assessed value of your property generally cannot increase by more than 2% per year, regardless of changes in market value. If your home is destroyed due to a disaster like a fire, you can rebuild without losing your Prop 13 tax benefits under certain conditions.

Here’s how it works:

- Rebuilding the same or similar structure: If you rebuild a home that is substantially equivalent to the original structure, the property tax basis will remain the same as it was before the disaster. In other words, Prop 13 protections continue to apply, and you won’t be reassessed at current market rates.

- Rebuilding a larger or different home: If you rebuild a significantly larger or different home, the additional value (above the original value) may be reassessed and taxed at the current market rate. The original portion of the home retains its Prop 13 protection.

- Application for reassessment exclusion: You’ll need to notify the county assessor and apply for property tax relief under these provisions. This is typically done through a Disaster Relief Claim Form or similar document, depending on the county.

- Timeframe for rebuilding: California law generally requires that rebuilding be completed within a specified timeframe (often 2–5 years) to qualify for the tax benefit, though this can vary by county and disaster circumstances.