California Assembly Republican Caucus

Wildfire Resources

Assembly Republican Solutions: Strengthening Wildfire Prevention, Emergency Response, and Recovery

Wildfire Prevention

ABX1 3 (Wallis) Provide Tax Relief for Home Hardening. Creates an income tax credit covering 40% of the costs for older homeowners in wildfire-prone areas to help them “harden” their homes.

ABX1 6 (Patterson) CEQA Exemption for Timberlands Fuels Reduction. Authorizes projects exclusively for noncommercial wildfire fuels reduction in timberland, paid for in part or in whole with public funds, to prepare a timber harvesting plan as an alternative to complying with CEQA, and would require these projects to be regulated as timber operations

ABX1 7 (Essayli) Exempt all Wildfire Prevention Projects from CEQA. Exempts all wildfire projects from CEQA requirements.

ABX1 8 (Essayli) Permitting Exemption for Controlled Burns. Requires air quality management districts (AQMDs) to process a permit for a smoke management plan within ten business days.

ABX1 9 (Essayli) Reduce Cost and Time for Undergrounding Power Lines. Exempts utility undergrounding projects from CEQA to cut down on permitting delays for projects intended to make our grid safer.

AB 267 (Macedo) Water Infrastructure and Wildfire Prevention. Redirects money from High-Speed Rail to pay for upgrades to water infrastructure and wildfire prevention.

AB 295 (Macedo): Streamline CEQA for Water Projects. Provides expedited CEQA review for water storage projects, water conveyance projects, and groundwater recharge projects.

AB 297 (Hadwick, Sanchez) Increase Penalties for Aggravated Arson. Creates a sentence enhancement for aggravated arson if a wildfire destroys more than 500 acres.

AB 300 (Lackey): Fire Marshall Update Fire Hazard Zones Every 5 Years.

AB 336 (Wallis): Increase Penalties for Recklessly Burning Forest Land. Removes the misdemeanor option applicable to a person who recklessly causes a fire of a structure or forest land and instead provides that this offense is a felony.

AB 389 (Wallis)/ABX1 3 (Wallis): Provide Tax Relief for Home Hardening. Creates an income tax credit covering 40% of the costs for older homeowners in wildfire-prone areas to help them “harden” their homes.

AB 441 (Hadwick) Maintain Funding for Wildfire Prevention. Prevents termination of the California Wildfire Mitigation Program (CWMP), which provides financial assistance for working families to fortify their homes against wildfires.

AB 442 (Hadwick, Tangipa) Exempt Roadside Wildfire Prevention Projects from CEQA. Expands an existing CEQA exemption for prescribed fire, thinning or fuel reduction projects to protect communities with only one fire evacuation route.

AB 513 (Gonzalez & Essayli)/ABX1 13 (Gonzalez): Tracking Greenhouse Gas Emissions. Requires the California Air Resources Board to include greenhouse gas emissions from wildlands and forest fires in the Scoping Plan. Creates parity with all other emissions sources tracked and recorded by CARB in the Scoping Plan.

AB 623 (Dixon): Reduces Red Tape for Fuel Reduction Projects and Fuel Modification Projects. Exempts fuel treatment projects from Coastal Commission permitting mandates.

AB 1467 (Hoover): Allow Homeowners to Quickly Remove Trees that Pose Fire Risk. This bill waives any state and local laws, ordinances, fees, and fines associated with the removal of a homeowner’s tree that their insurance has identified as a fire risk.

Improve Fire Safety Egress. Creates a pilot program to exempt fire safety egress route projects from CEQA in high or very high fire hazard severity zones.

Wildfire Response

ABX1 11 (Macedo) Increase Penalties for Drones Near Fires. Makes it a felony to fly a drone that interferes with law enforcement, firefighters, emergency medical personnel or other first responders at the scene of an emergency.

AB 271 (Hoover) Increase Penalties for Looting. Makes it a felony to commit burglary or grand theft in an area where there has been a declared state of emergency, local emergency, or which is under an evacuation order. Increases the penalty from a misdemeanor to an alternate felony/misdemeanor (“wobbler”) for committing petty theft under those circumstances.

AB 438 (Hadwick) Faster OES Response Times. Allows local Office of Emergency Services vehicles to be authorized emergency vehicles and drive Code 3 (using lights & sirens) to expedite evacuations and provide immediate assistance.

Wildfire Recovery

ABX1 10 (Macedo) Support Nonprofits Providing Essential Services. Improves nonprofits’ ability to provide services during emergencies. (Reintroduction of AB 619 (V. Fong, 2023))

ABX1 14 (Castillo): Exempts Power Generator Purchases During Declared State of Emergency. Permit the sale of generators banned by CARB during a declared state of emergency, as well as create an income tax write-off for generator purchases all year round.

AB 294 (Gallagher) Prioritize Aid to Vulnerable Communities. Allows the California Office of Emergency Services (Cal OES) to prioritize funding and assistance to communities heavily impacted by disasters/emergencies.

AB 429 (Hadwick) Tax Relief for Wildfire Survivors. Exempts wildfire payments from income tax and allows victims of the 2021 Dixie Fire, the 2022 Mill Fire, and the 2024 Park Fire to receive the full payments they are owed.

AB 624 (Dixon) Increase Aid to Local Communities. Creates a grant program to provide financial assistance for disaster costs when federal assistance is not available.

AB 738 (Tangipa & Patterson): Suspend Solar Mandate when Rebuilding Damaged Homes. Permits the temporary suspension of solar requirements when rebuilding homes that were damaged or destroyed as a result of a natural disaster.

USFS Region 5 Wildfire Crisis

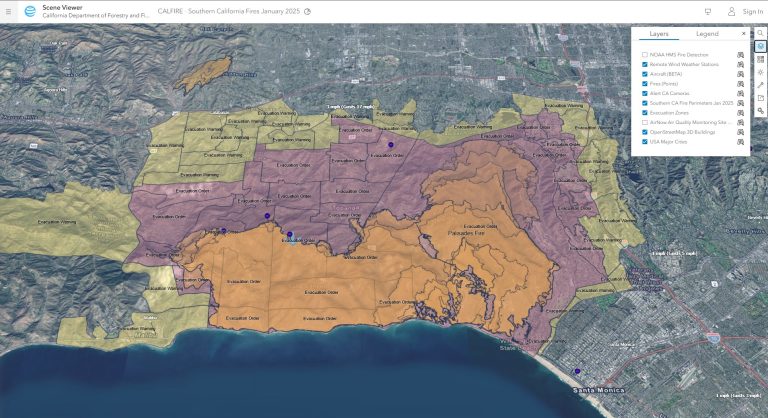

CAL FIRE Interactive Maps

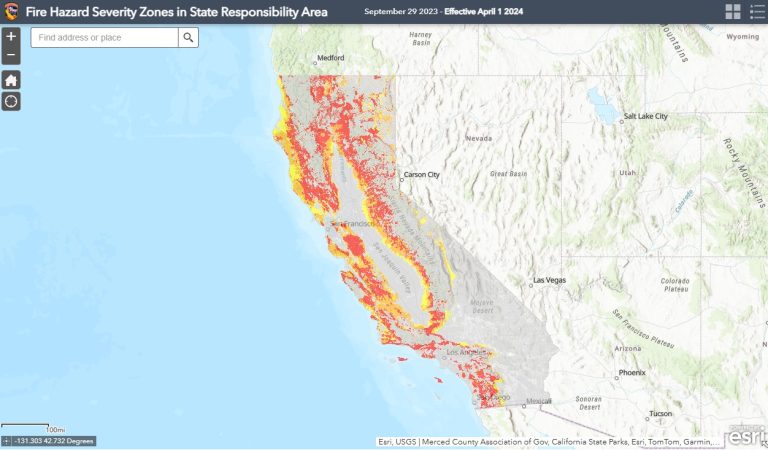

Fire Hazard Severity Zones

CAL FIRE Resource Page

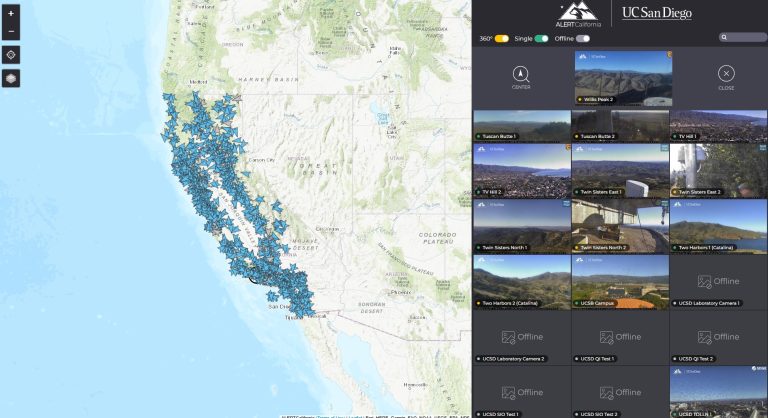

Alert Wildfire Interactive Cameras

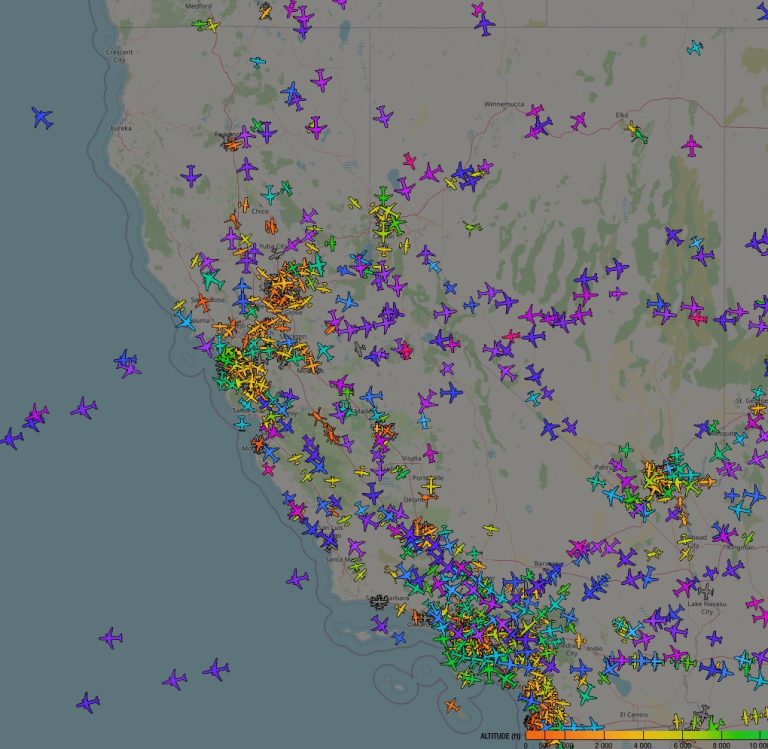

ADSB Flight Tracking

Listen to Broadcastify

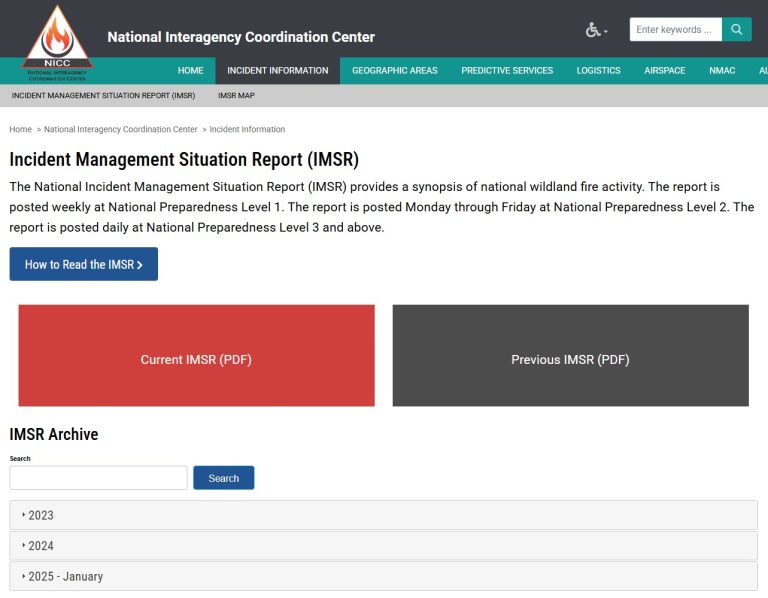

National Interagency Coordination Center - Incident Management Situation Report (IMSR)

Resources for Rebuilding

1. Ensure Your Safety

– Prioritize the safety of yourself and your family.

– Follow evacuation orders and wait until it is safe to return to your property.

2. Document the Damage

– Take photos and videos of the damage if it’s safe to do so. Document the loss thoroughly.

– Create a list of damaged or lost items, including their approximate value.

3. Contact Your Insurance Company

– Notify your homeowner’s insurance company immediately.

– Request a copy of your policy if you don’t have it.

– Start the claims process by providing your policy number and the details of the loss.

– Ask about additional living expenses (ALE) coverage for temporary housing and related costs.

4. File an Insurance Claim

– Provide your insurance adjuster with all necessary documentation, including:

– Photographs/videos of the damage.

– Inventory of lost or damaged belongings.

– Receipts or proof of purchase for major items (if available).

– Maintain a log of all interactions with your insurance company, including dates and times.

5. Explore State and Federal Assistance

– Contact the **California Office of Emergency Services (Cal OES)** or FEMA to see if you’re eligible for disaster assistance.

– Register with FEMA at (https://www.disasterassistance.gov) or call 1-800-621-FEMA.

– Apply for a Small Business Administration (SBA) disaster loan if needed for rebuilding.

6. Secure Temporary Housing

– Use ALE from your insurance policy to cover temporary housing costs, meals, and transportation.

– Check with local relief organizations, such as the Red Cross, for assistance.

7. Prevent Further Damage

– If possible, take steps to mitigate further damage (e.g., boarding up windows or tarping roofs).

– Keep receipts for any expenses related to securing your property.

8. Obtain Building Permits

– Contact your local government to understand rebuilding requirements and zoning codes.

– Obtain necessary permits before starting construction.

9. Work with Contractors

– Choose a licensed, insured, and experienced contractor.

– Request written estimates and review contracts carefully.

– Avoid paying large upfront deposits.

10. Monitor the Rebuilding Process

– Work closely with contractors and inspectors to ensure quality and compliance.

– Maintain regular communication with your insurance adjuster.

11. Seek Legal or Professional Advice

– Consult a public adjuster or attorney if disputes arise with your insurance company.

– Consider hiring a financial advisor to help manage rebuilding costs.

12. Stay Informed

– Follow updates on fire recovery efforts from local authorities and community organizations.

– Stay organized with all documents and receipts in case of future audits or additional claims.

Prop 13

Under California’s Proposition 13, the assessed value of your property generally cannot increase by more than 2% per year, regardless of changes in market value. If your home is destroyed due to a disaster like a fire, you can rebuild without losing your Prop 13 tax benefits under certain conditions.

Here’s how it works:

- Rebuilding the same or similar structure: If you rebuild a home that is substantially equivalent to the original structure, the property tax basis will remain the same as it was before the disaster. In other words, Prop 13 protections continue to apply, and you won’t be reassessed at current market rates.

- Rebuilding a larger or different home: If you rebuild a significantly larger or different home, the additional value (above the original value) may be reassessed and taxed at the current market rate. The original portion of the home retains its Prop 13 protection.

- Application for reassessment exclusion: You’ll need to notify the county assessor and apply for property tax relief under these provisions. This is typically done through a Disaster Relief Claim Form or similar document, depending on the county.

- Timeframe for rebuilding: California law generally requires that rebuilding be completed within a specified timeframe (often 2–5 years) to qualify for the tax benefit, though this can vary by county and disaster circumstances.